House rules - Germany's liberalised market has 900 suppliers, but no-one is switching

20.12.2002

House rules - Germany's liberalised market has 900 suppliers, but no-one is switching

Dr. Christoph Müller

Veröffentlicht auf LinkedIn am 20.12.2002

In 1998 the German ESI was liberated. The German Government took a very different approach towards regulation compared with other EU countries. The entire industry was liberalised in one go. All customers, domestic, SME or industrial, were eligible to change supplier from the 24. April 1998. Since then, there has been a lot of discussion about competition in the German ESI. This article analysis the development of retail prices since 1998.

Prices Development in the German ESI

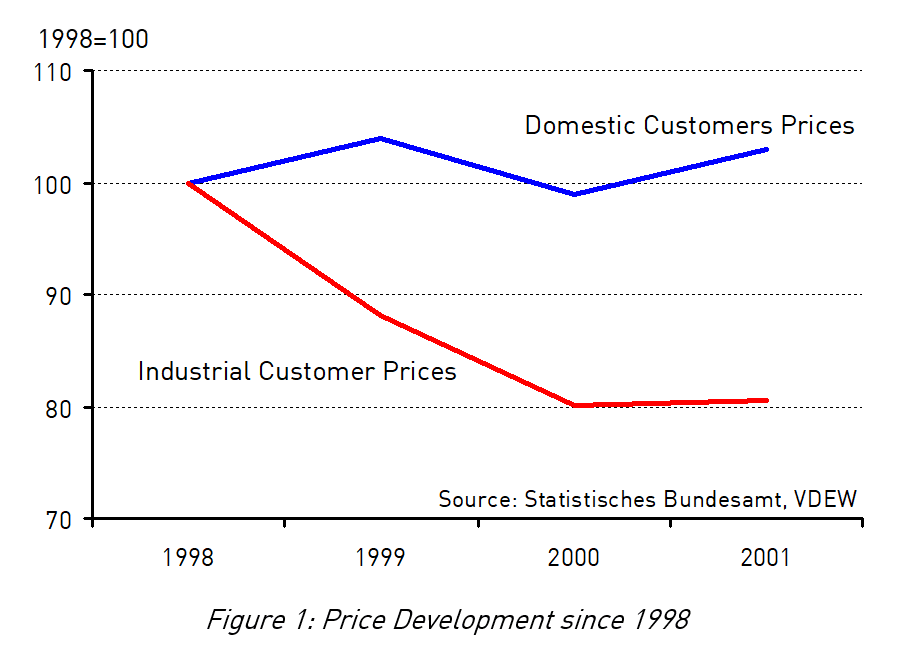

Industrial customer experienced a sharp drop in prices soon after liberalisation (figure 1). Domestic customers on the other hand did not get a similar price reduction. Their prices remain rather stable, if not increasing, over time.

The sharp difference between the price developments of industrial and domestic customers is one of the arguments commonly used to highlight a low intensity of competition in the German electricity retail market. However, the comparison of figure 1 is too simplistic, especially when considering domestic prices. Firstly, Government has introduced several new taxes, which affected especially domestic customers. Secondly, figure 1 shows the development of integrated electricity price, that is the price covering (apart from taxes) power and retail costs as well as transmission and distribution.

To show the true effect of competition one has to look on the competitive component of retail prices only, with all tax effects removed.

New taxes since 1998

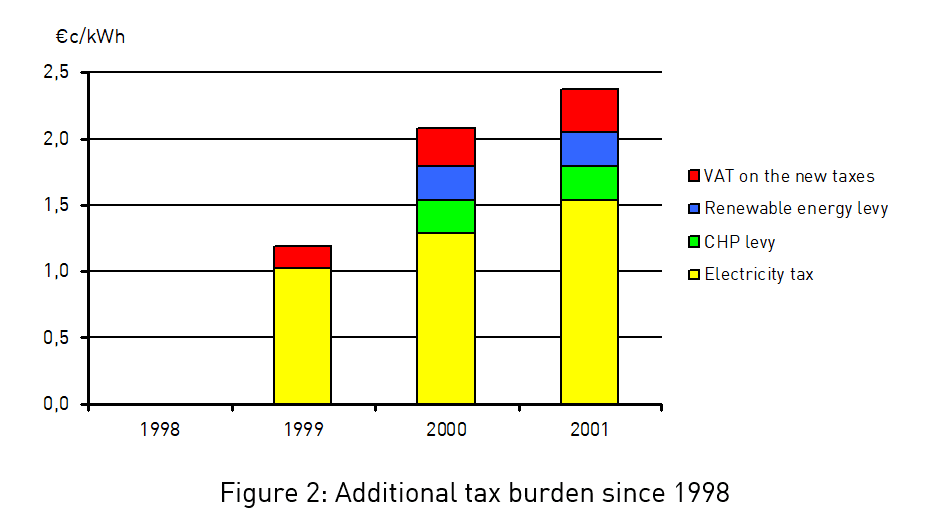

The taxation on electricity was always on a relatively high level. In 1998, on third of the average domestic electricity bill was taxation. Next to VAT (applied with the full rate of 16%) there is a municipal tax of up to €c2,4/kWh (1,5p/kWh; €1 = £0,64), depending on the size of the city. As figure 2 shows, the tax burden has increased by a further €c2,4/kWh (1,5p/kWh) between 1998 and 2001.

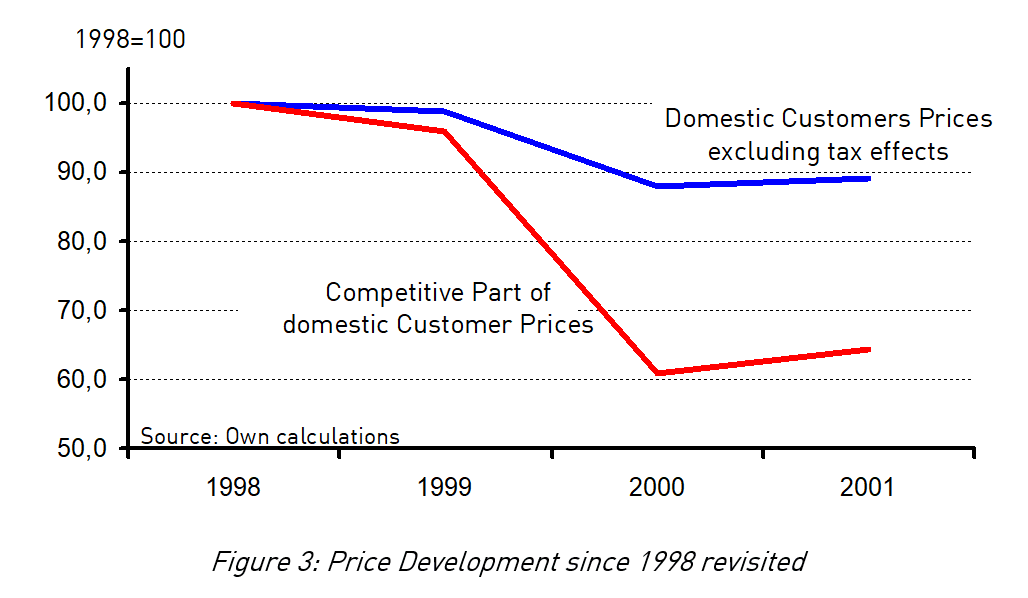

In order to show the competitive development of retail prices in Germany, the price development in figure 1 has to be corrected for the tax effects. As the stablish development of total domestic electricity prices suggests, these tax increases have not been handed on to end customers. Supplies had to “swollow” the tax increases because of the competitive pressure. The blue line in figure 3 shows the development of net electricity prices since liberalisation.

Competition for domestic customers took off at the end of 1999 with the introduction of Yello Strom, the first supplier going for domestic customers. Yello acquired about half of all customers that changed supplier and can be regarded as a “market maker”. Since 2001 Yello is gradually increasing prices. From this point of view, the overall “history of the market” and the development of domestic prices excluding tax effects fit.

Development of the “competitive part” in domestic electricity prices

So far “all-inclusive” prices have been considered. The “all-inclusive” price has competitive (i.e. power and retail costs) as well as non-competitive components (i.e. networks and taxation). Network prices are far more difficult to track, as there are over 900 network owners in Germany. Network charges are not available for all the time back to 1998, but for the time that network charges are published by network owners they have hardly changed. Assuming stable network charges, the non-competitive components made about two thirds of the all-inclusive price in 1998. The reduction of the all-inclusive price was hence delivered by only a small proportion of the all-inclusive price, making the relative price reduction far bigger (red line in figure 3). The red line indicates the reduction in earnings for electricity suppliers since 1998. The supply revenues decreased by about 40%.

Looking at actual domestic electricity prices in Germany, one can easily find that firstly, the revenue decrease in supply really seems to be in the order of 40%. One can also conclude, why it is that no incumbent supplier has gone out of business so far.

Actual domestic prices in the German ESI

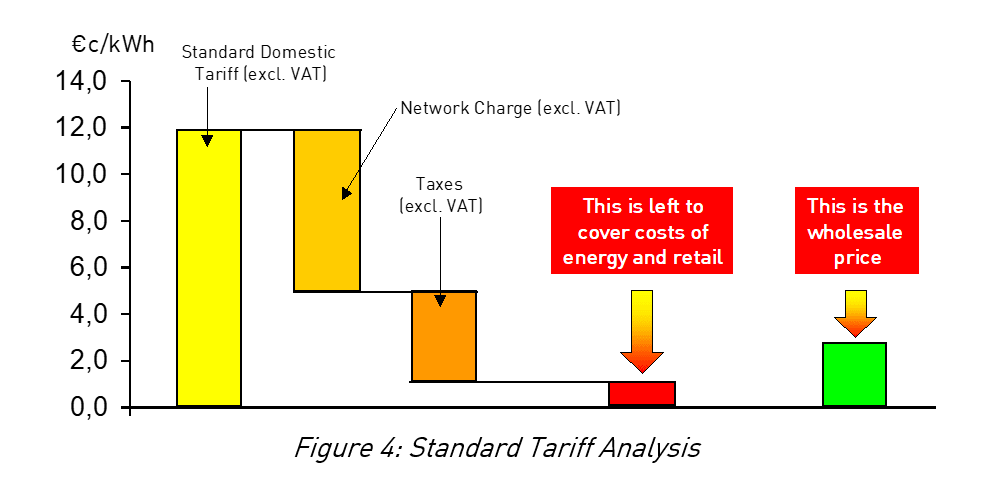

Figure 4 shows the analysis of the Standard Tariff of a municipal electricity supplier of a city with about 100.000 inhabitants (prices as of July 2002) without any own generation assets.

As one can see, about €c1/kWh (0,64p/kWh) is left to cover costs of energy and retail. Current wholesale prices for a domestic load profile are just below €c3/kWh (1,9p/kWh). Even assuming retail costs of zero and favourably purchase conditions, there is no way that the standard tariff can cover costs. This picture of a competitive component (substantially) below wholesale price is similar for many other incumbent suppliers. One can even find examples where the competitive component is below zero. Where did the money go?

Electricity companies made a profit before liberalisation. As most on-suppliers where able to improve their purchase-conditions after liberalisation, it is sensible to assume that the 10% reduction in all-inclusve-revenues (blue line in figure 3) has not destroyed the overall profitability of the incumbent electricity companies in Germany. One answer to this riddle is that many of the incumbent electricity companies moved their margins into the network charges.

It is all in the networks

Moving margins into the network tariff has several attractions. Firstly, it is very difficult (if not impossible) for a new entrant to make a competitive offer. In the situation of figure 4, an independent electricity supplier who has got to source himself from the wholesale market will not be able compete. Secondly, even if a new entrant is able to acquire customers (for example because of better sourcing conditions or cross-selling), then the margin is not lost for the incumbent. Via the network charge the competitor will maintain the profitability of the incumbent.

Thirdly, there is very little pressure on network tariffs. Regulation of network charge is very lax in Germany, especially if compared to the UK. There is no regulator and very little specific regulation. Industry supervision is done by a few people within the Federal Competition Offices. The few rules that do exists can be interpreted in many ways. Especially smaller network owners of the 900 can hope not to show up on the “radar screen” of the authorities.

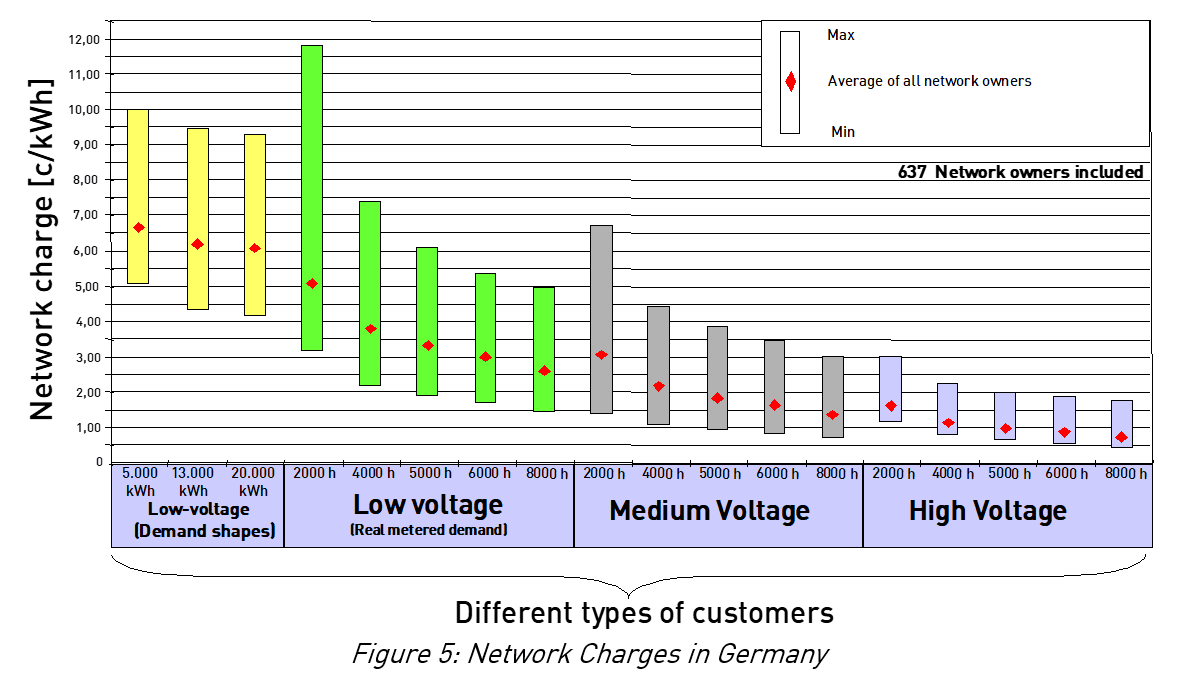

The result of this lax regulation is a huge variety of network charges. Figure 5 shows the bandwith for differennt demand cases.

For example, for a domestic customer with a demand of around 5000 kWh/year network charges can vary between €c5/kWh (3,3p/kWh) and €c10/kWh (6,6p/kWh). There have been several attempts to explain this variety of charges with differences in the structure of networks, e.g. population density, share of underground cableing or difference between lowest and highest point of the network area. Despite all efforts, no correlation between network charges and any objective criteria has been found so far. Even correlating the network charges of the very same network owner does not work: Those network owners with a low load-profiled-low-voltage-customer charge do not also have a low charge for real-metered-low-voltage-customers.

In the beginning of 2002 the Bremer Energie Institut investigated network charges in Germany. Pointing out difficulties because of the lack of public data, they nevertheless estimated the overall volume of overcharged network income as approx. €800m (£530m) per year.

Summary

Prima facie domestic electricity prices have been stable since liberalisation. However, analysing the situation one can find that the revenues for electricity suppliers have decreased dramatically by around 40%. Around one quarter of this decrease Government “used” to introduce new taxes. The remaining three quarters are less a margin reduction than a margin movement from supply to networks. Many incumbent electricity companies chose to overcharge their network services in order to protect their historic monopoly. The –in the end artificial- decrease of the competitive component of domestic electricity prices goes to the detriment of independent suppliers, who do not have an affiliated network to “back them”. The list of independent electricity suppliers that went out of business is already long (Abos, Deutsche Strom AG, Energybynet, Astromo, Zeus Strom, Zweitausend Stromvertrieb, ...).

[Veröffentlicht in Utility Week, 20. Dezember 2002, S. 16/17]

Dr. Christoph Müller

www.linkedin.de/mueller-energieWeitere Artikel

Bleiben Sie auf dem Laufenden

Tragen Sie sich jetzt in meinen Newsletter ein, um benachrichtigt zu werden, wenn ein neuer Artikel erscheint.

Sie haben eine Frage oder ein spannendes Thema?

Kontaktieren Sie mich gerne per E-Mail.